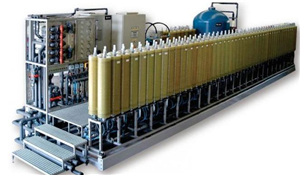

Membrane separation technology is a new and highly efficient unit operation for fluid separation. It has achieved significant accomplishments in recent years and is now widely applied across various industries, playing an important role in energy conservation, consumption reduction, clean production, and the circular economy. So, what are the characteristics of its development in China?

1.China faces a relatively severe scarcity of water resources, which creates a significant contradiction with the development of its national economy.

2.China's membrane separation industry is already fully commercialized. Furthermore, several renowned international membrane manufacturers and engineering contractors have entered the Chinese market, making competition extremely fierce.

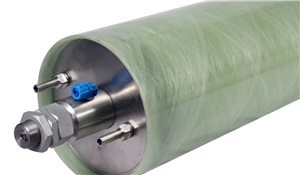

3.Although there is a gap between domestic membrane products and those from internationally renowned manufacturers, most meet engineering requirements. Some membrane products are of high quality and have earned a good reputation.

4.The composition of talent engaged in membrane separation research in China differs from that in North America and Europe: China has an advantage in the number of practitioners but lacks management talent, especially outstandingmanagement talent.

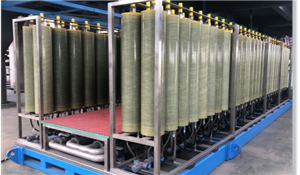

5.Market composition: The proportion of Reverse Osmosis (RO) in China is excessively large, and the usage of Ultrafiltration (UF) far exceeds that of Microfiltration (MF). This is due to historical reasons as well as differences in application philosophy.

6.The majority of membrane elements, membrane materials, etc., in China rely on imports. According to data, about 80% of membrane materials need to be imported, and most key auxiliary materials for manufacturing RO elements have not yet been localized.

7.Domestic companies are generally small in scale and have limited independent R&D capabilities, making it difficult to establish brands. Moreover, most products and technologies are similar or identical. The membrane industry in China is primarily composed of small and medium-sized enterprises; only 2% have an annual output value exceeding 100 million RMB, and they lack distinctive features, making it hard to form core competitiveness.

8.Foreign companies control a large share of the Chinese membrane and engineering project market. Most internationally famous membrane element manufacturers and water companies have entered the Chinese market, with some even establishing R&D centers and manufacturing plants in China.

9.There is a wide variety of membranes and membrane elements, disorganized model nomenclature, a lack of unified technical standards, and no strict market access system.

10.Domestic membrane research institutions are often also membrane product manufacturers and engineering contractors. The chain from research to production to engineering application is very long. After commercial operations begin, it is difficult for research institutions to conduct independent innovation R&D. Due to interests and commercial confidentiality, deep cooperation with other manufacturers is also challenging.

Henan Yuanhede Industrial Technology Co., Ltd.

East Industrial Park, Yuzhou City, Henan Province, China.

(+86)139 3822 7726

info@yhdegroup.com

www.yhdegroup.com